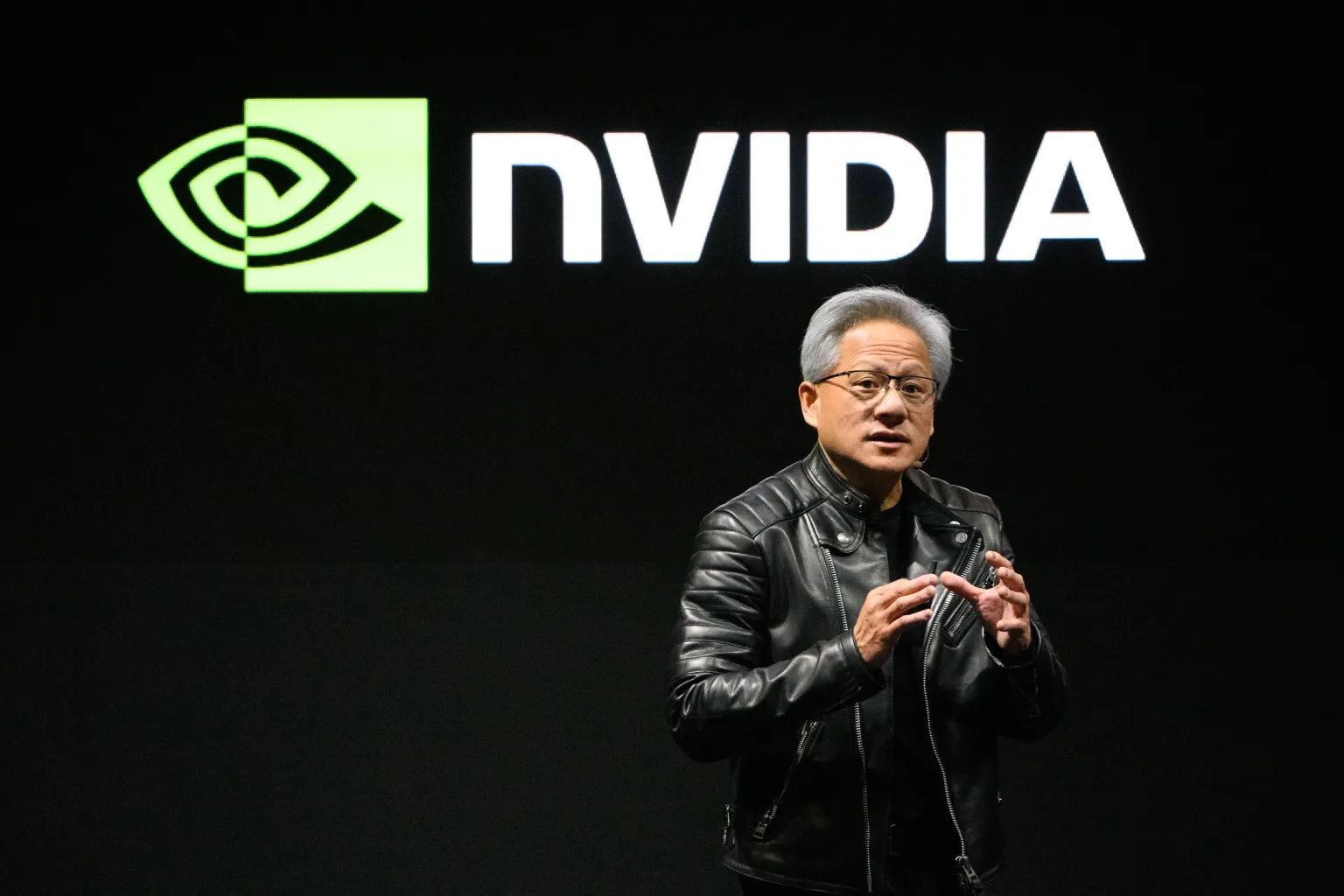

No company has ridden the AI wave quite like Nvidia. Since the explosive debut of ChatGPT more than two years ago, followed by a flood of generative AI tools, Nvidia has experienced a meteoric rise in revenue, profit, and market valuation. The company’s stock has soared, and its cash reserves are now fueling a strategic expansion that goes far beyond GPUs—into the very heart of the AI ecosystem.

From chip supplier to startup kingmaker, Nvidia is now emerging as one of the most aggressive and influential corporate investors in artificial intelligence.

According to fresh data from PitchBook, Nvidia participated in 49 funding rounds for AI companies in 2024—up from 34 in 2023. That figure surpasses the total number of deals (38) it made in the previous four years combined. These figures don’t even include investments made by its dedicated venture capital arm, NVentures, which jumped from just 2 deals in 2022 to 24 in 2024.

As of mid-2025, Nvidia has already joined seven more AI funding rounds, signaling its intent to stay on the offensive.

The Strategy: Building the AI Stack

Nvidia says its corporate investing strategy is simple: back “game changers and market makers” that will expand and enrich the AI ecosystem. That means betting big across the full stack—from data centers and LLMs to robotics, cloud platforms, and synthetic media.

Here’s a breakdown of Nvidia’s biggest investments, based on publicly disclosed rounds over $100 million since 2023.

Major Billion-Dollar Investments

OpenAI raised $6.6 billion in 2023, with Nvidia reportedly contributing $100 million to the round. While smaller than investments by firms like Thrive Capital, Nvidia’s involvement marked a pivotal alignment with the AI leader behind ChatGPT.

Elon Musk’s xAI closed a $6 billion round in 2024, with Nvidia signing on despite being a backer of OpenAI. The move highlighted Nvidia’s determination to support multiple players in the generative AI space.

Inflection AI, co-founded by DeepMind alum Mustafa Suleyman, raised $1.3 billion in June 2023 with Nvidia as a lead investor. The company later saw key talent and technology absorbed by Microsoft, shifting its future direction.

Wayve, a UK-based autonomous driving startup, raised $1.05 billion in May 2025. Nvidia joined the round to support the development of its self-learning driving platform.

Scale AI secured $1 billion in May 2024 with participation from Nvidia, Meta, Amazon, and Accel. The data-labeling company is seen as a vital enabler for training large AI models.

High-Value Strategic Rounds

Crusoe raised $686 million in November 2024. The AI-focused data center company, said to be working with Microsoft, Oracle, and OpenAI, lists Nvidia among its backers.

Figure AI, a robotics company developing humanoid machines, raised $675 million in February 2024 with Nvidia, Microsoft, and OpenAI’s startup fund contributing.

Mistral AI, a French LLM developer, received a $640 million Series B in June 2025. Nvidia re-invested after first backing the company in 2023.

Lambda, which rents out Nvidia GPUs for training AI models, raised $480 million in February 2024. Nvidia joined other high-profile investors including ARK Invest.

Cohere, a large language model provider for enterprise clients, secured $500 million in June 2025. Nvidia has supported the Toronto-based startup since 2023.

Perplexity AI, known for its AI search engine, raised $500 million in December 2024. Nvidia has participated in all of the company’s recent funding rounds, helping it reach a $9 billion valuation.

Poolside, an AI-powered coding assistant startup, raised $500 million in October 2024. The round valued the company at $3 billion and included Nvidia among its top investors.

Infrastructure and Cloud Plays

CoreWeave raised $221 million in April 2023. It rents out Nvidia GPUs on an hourly basis and has grown from a $2 billion company to a $19 billion AI infrastructure giant preparing for IPO.

Together AI secured $305 million in February 2025, offering cloud-native infrastructure for training AI models. Nvidia first backed the company in 2023.

Sakana AI, based in Japan, raised $214 million in September 2024. The company is developing efficient generative AI models using smaller datasets.

Imbue, a research lab focusing on reasoning and code generation, raised $200 million in September 2023 with Nvidia among its key backers.

Waabi, an autonomous trucking company, raised a $200 million Series B in June 2025. Nvidia joined Uber, Khosla Ventures, Volvo, and Porsche in backing the round.

Enterprise AI and Specialized Startups

Ayar Labs raised $155 million in December 2023. Nvidia invested in the optical interconnect developer to support power-efficient AI computing.

Kore.ai, which builds enterprise-grade chatbots, raised $150 million in December 2023. Nvidia joined a roster of institutional investors supporting its growth.

Sandbox AQ, developing large-scale quantitative AI models for finance and science, raised $150 million in April 2025. Nvidia invested alongside Google and BNP Paribas.

Hippocratic AI raised $141 million in January 2025 to build AI systems for patient-facing healthcare tasks. Nvidia was joined by Kleiner Perkins and a16z in the round.

Weka, which specializes in data platforms optimized for AI workloads, raised $140 million in May 2025. Nvidia’s participation helped push the company to a $1.6 billion valuation.

Runway, a generative video tool for creatives, raised $141 million in a Series C extension in 2023. Nvidia joined Google and Salesforce as co-investors.

Bright Machines, an AI-driven smart manufacturing startup, raised $126 million in June 2024. Nvidia participated in the Series C round.

Enfabrica, which builds networking chips for data-heavy AI applications, raised $125 million in September 2023. Nvidia participated in that round but did not join a subsequent $115 million round in November.

Editor’s Note (TechMarge Correction)

A previous version of this article incorrectly stated that Nvidia had invested in Safe Superintelligence and Vast Data’s Series E. Nvidia has not participated in those rounds since Vast’s Series D.

Conclusion: From Silicon to Strategy

Nvidia’s GPU dominance is undisputed—but its ambitions clearly go beyond chipmaking. By investing across the entire AI ecosystem—from model builders and data infrastructure to robotics and healthcare—Nvidia is shaping the future of artificial intelligence at every layer.

This isn’t just venture capital. It’s strategic architecture. As AI continues to reshape industries, Nvidia is ensuring it’s not just supplying the tools, but influencing the direction of innovation itself.